GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and is used herein with permission. All rights reserved.

Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, express or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

Download the 2024 Gartner® Market Guide for KYC Platforms for Banking

In an evolving financial services landscape, ensuring regulatory compliance and protecting from fraud is crucial. Facephi has been recognised as a Representative Vendor in the Gartner® Market Guide for KYC Platforms for Banking.

Access the report to:

- Obtain market recommendations in line with the characteristics and needs of your organisation.

- Find out how the rise of artificial intelligence is transforming KYC, with solutions that combat deepfakes, synthetic identities and other emerging fraud tactics.

- Find out how to evaluate your current KYC strategy and discover the potential of implementing pKYC (Perpetual KYC).

Download the 2024 Gartner® Market Guide for KYC Platforms for Banking.

Security

Why is Facephi the best KYC option for your organisation?

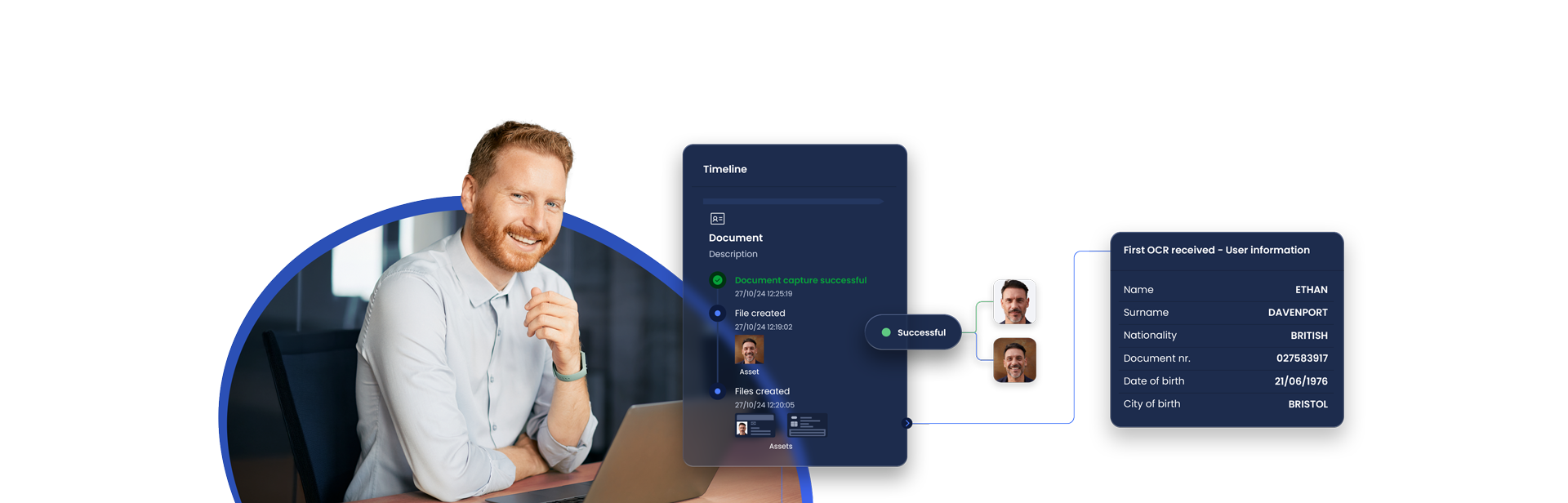

Check identities in less than 10 seconds

Validate people's identity in an automated way and in real time, to ensure that they are genuine users and not an attempted fraud, adapting to the needs and business flows of each client. Recognise and extract any identity document and check that the user is the legitimate holder of the document. Connection to government and other databases.

Achieve conversion rates of over 89%

With more than 20,000 official documents supported and thanks to advanced facial recognition technology based on artificial intelligence and passive liveness, we provide a speedy, secure verification system which is compliant with all regulations such as eIDAS 2 or GDPR. More than 190 banking institutions have placed their faith in us.

Reduced fraud

With more than 300 million verified users, our advanced anti-fraud technology blocks all fraud attempts. Powerful advanced behavioural biometrics and AI algorithms analyse and detect suspicious patterns in real time.