Mule Account Detection

The use of mule accounts is a common tactic in fraud and money laundering schemes. These accounts, used to move illicit funds, may belong to deceived users, accomplices, or even be created with false identities. Detecting them early is crucial to avoid financial losses, regulatory penalties, and reputational damage.

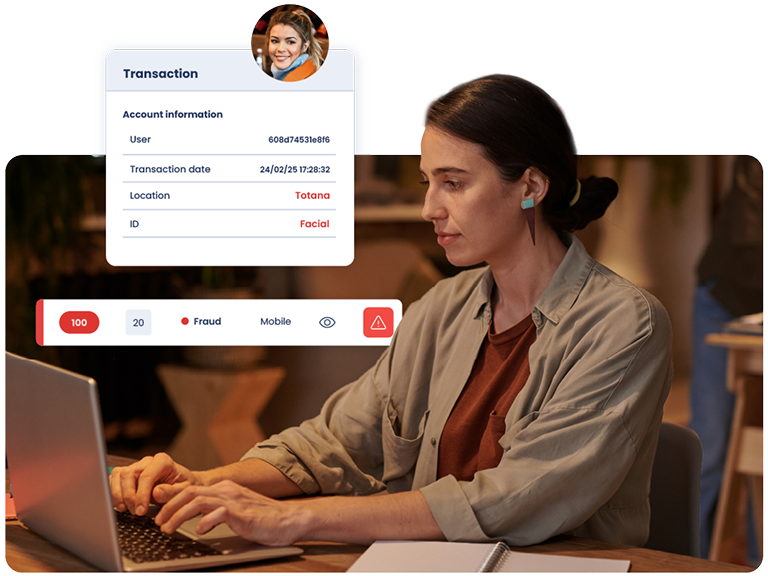

Our technology combines artificial intelligence, machine learning, and behavioral analysis to identify suspicious accounts from the very first moment and stop their activity before it causes harm.